Table of Contents

Welcome to Yolk Life: Life Insurance for Today

Life insurance doesn’t have to be stale, confusing, or something you only think about when you’re older. At Yolk Life, we’re cracking open the old rules and serving up life insurance that works for you—today, tomorrow, and for the future you’re building.

Whether you’re protecting your loved ones, building tax-free wealth, or planning for the unexpected, we’ve got you covered. This isn’t your grandparents’ life insurance. It’s life insurance for the way you live now.

What Makes Yolk Life Different?

Tax-Free Wealth Generation

Your policy isn’t just a safety net—it’s a financial tool. Grow your cash value over time, tax-free, and use it to fund your dreams, invest in your future, or create a legacy.

Living Benefits

Why wait? Access your policy’s benefits while you’re alive. Whether it’s covering medical expenses, funding a big life moment, or just having extra cash on hand, your policy works for you—not just your beneficiaries.

Annuities for Lifetime Income

Planning for retirement? Our annuities provide guaranteed income for life, so you can enjoy your golden years without worrying about running out of money.

Designed for You

We get it. Life moves fast, and your priorities change. That’s why our policies are flexible, affordable, and built to grow with you.

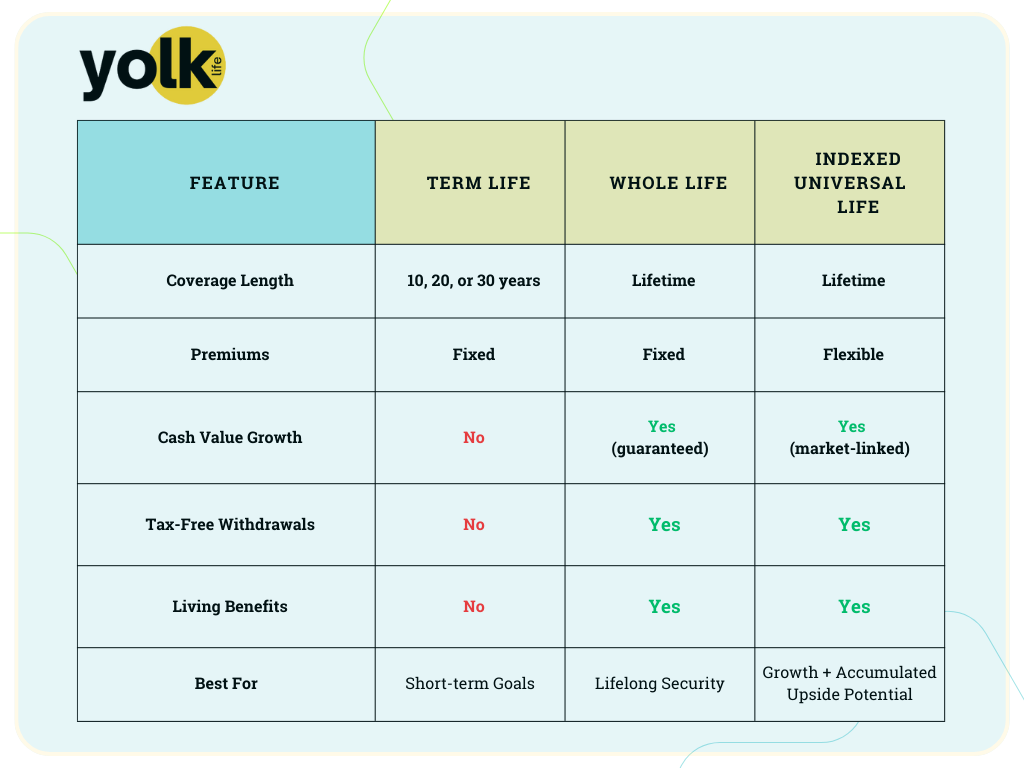

Types of Life Insurance Policies

Term Life Insurance

What It Is: Affordable coverage for a set period (10, 20, or 30 years).

Why It’s Great: Perfect for covering specific goals like paying off student loans, protecting your family, or securing a mortgage.

Pro Tip: Think of it as “renting” coverage. It’s simple, straightforward, and gets the job done. But there’s a better way.

Whole Life Insurance

What It Is: Lifetime coverage with guaranteed cash value growth.

Why It’s Great: Build wealth over time, enjoy lifelong protection, and access living benefits.

Pro Tip: Your cash value grows tax-free, and you can borrow against it for big life moments.

Indexed Universal Life Insurance

What It Is: Flexible coverage with cash value growth tied to market indexes (like the S&P 500).

Why It’s Great: Grow your cash value with accumulated upside, but without the risk of losing it all.

Pro Tip: A smart way to combine life insurance with long-term wealth building.

Policy Comparison

Annuities: Income for Life

What Are Annuities?

Annuities are a financial product designed to provide you with a steady stream of income during retirement. Think of it as your personal paycheck for life.

Why Choose Yolk Life Annuities?

· Guaranteed Income: Never worry about outliving your savings.

· Tax-Deferred Growth: Your money grows tax-free until you start withdrawing.

· Flexible Payouts: Choose when and how you receive your income.

Types of Annuities

1. Fixed Annuities: Steady, predictable income with no market risk.

2. Variable Annuities: Income tied to market performance for higher growth potential.

3. Indexed Annuities: Growth linked to market indexes with downside protection.

Living Benefits: Use Your Policy While You’re Alive

What Are Living Benefits?

Living benefits allow you to access your life insurance policy’s benefits while you’re still alive. It’s like having a financial safety net for life’s unexpected moments.

How You Can Use Living Benefits

· Medical Expenses: Cover unexpected medical bills or long-term care costs.

· Emergency Fund: Access cash for emergencies like job loss or home repairs.

· Big Life Moments: Fund a wedding, start a business, or take a dream vacation.

Why It’s a Game-Changer

Living benefits turn your life insurance into a living, breathing financial tool. It’s not just about protecting your loved ones—it’s about empowering yourself.

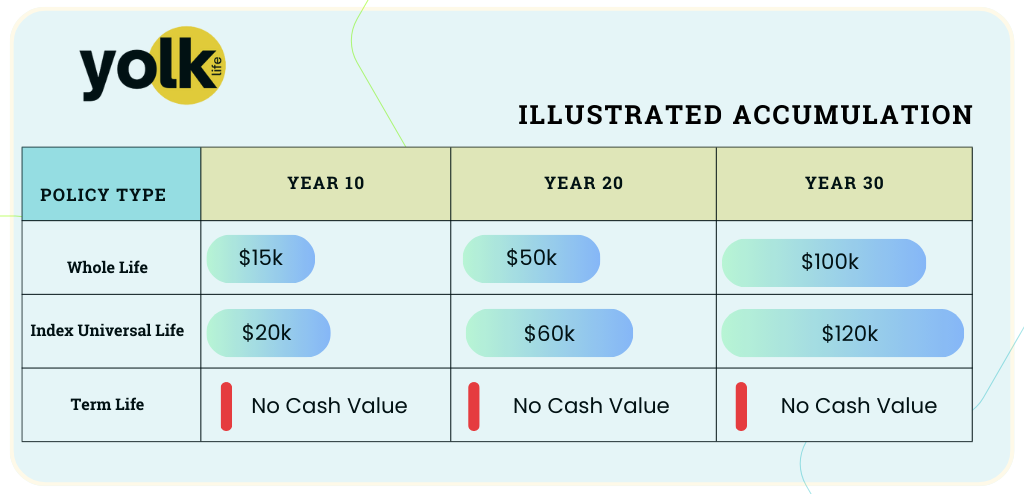

Cash Value Growth

Look – not all plans are the same, let’s take a look at growth of cash value over 30 years for Whole Life, and Indexed Universal Life policies.

· Whole Life: Steady, guaranteed growth.

· Indexed Universal Life: Higher growth potential, linked to market performance.

·Term Life: No Cash Value

For What It’s Worth: Indexed Universal Life has the highest growth potential, while Whole Life offers steady, predictable growth.

note: For illustration purposes only

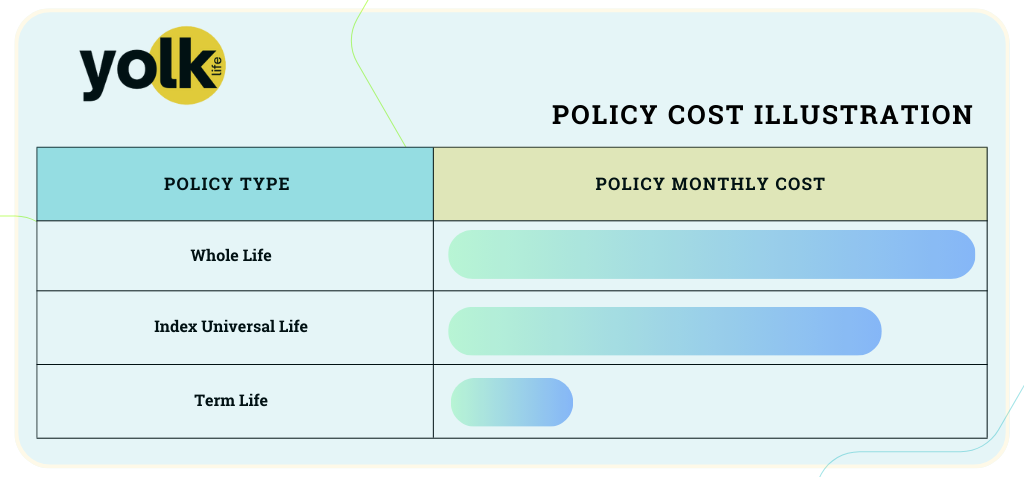

Policy Costs Over Time

For What It’s Worth: Term Life is the most affordable, but permanent policies (Whole, Universal, Indexed Universal) offer long-term value through cash value growth and living benefits.

note: For illustration purposes only

Frequently Asked Questions

For What It’s Worth:

1. Why should I choose Yolk Life over a big-name insurance company?

A: At Yolk Life, we’re not a giant corporation with massive overhead—we’re just like you. We understand this generation’s financial concerns and priorities. Our mission is to change the way you see life insurance, helping you build wealth while protecting your future. We offer personal service, real flexibility, and products that fit the way you live.

2. What makes Yolk Life’s life insurance different?

A: We offer policies with living benefits, tax-free wealth generation, and flexible protection—so you don’t have to wait decades to see value from your policy. Whether it’s protecting your loved ones, securing lifetime income, or accessing cash for big life moments, Yolk Life gives you more than just a death benefit.

3. What are living benefits, and how do they work?

A: Living benefits allow you to access your policy’s funds while you’re still alive. You can use them for medical expenses, home purchases, business investments, or even to cover unexpected emergencies. This means your life insurance is working for you now, not just when you’re gone.

4. Can I really use life insurance to build wealth?

A: Yes! Policies like Whole Life, Universal Life, and Indexed Universal Life let you build tax-free cash value over time. Think of it like a personal savings account that grows and can be used for investments, retirement, or even starting a business.

5. How do Indexed Universal Life (IUL) policies work?

A: IUL policies grow cash value based on the performance of market indexes (like the S&P 500), but with built-in protections against market downturns. This means you gain from market growth while avoiding losses, making it a smart long-term financial strategy.

6. What’s the difference between Term Life and Whole Life insurance?

A: Term Life is affordable and lasts for a set period (10, 20, or 30 years). It’s great for temporary needs like covering a mortgage or student loans.

Whole Life lasts forever and builds cash value you can borrow against, making it a wealth-building tool.

If you’re looking for long-term financial growth, Whole Life or Indexed Universal Life might be the better fit.

7. What happens if I want to change my policy later?

A: No worries! With Yolk Life, you can adjust, upgrade, or even convert your policy as your life changes. Whether you’re getting married, buying a house, or growing your family, we make sure your coverage grows with you.

8. How does life insurance compare to other retirement savings options?

A: Unlike traditional retirement accounts, life insurance with cash value offers:

- Tax-free withdrawals (unlike 401(k) and IRA withdrawals, which are taxed)

- No contribution limits (you can build more wealth over time)

- Market-linked growth without risk (for Indexed Universal Life policies)

- Guaranteed income for life (with annuities)

This makes it a powerful tool for retirement planning and financial security.

9. How much does life insurance cost?

A: It depends on factors like age, health, and the type of policy you choose. Term Life is the most affordable, starting at around $20/month, while Whole Life and Indexed Universal Life offer higher long-term value through cash growth and living benefits.

10. How do I get started with Yolk Life?

A: It’s simple! Just schedule a call with us, and we’ll walk you through your options. No pressure, no confusing jargon—just clear, straightforward answers to help you find the right plan.

Still not sure

We Get It: We threw a lot at you here…It’s ok that you still don’t know what to do. But that’s why we are here. Fill out the form today and we will get a friendly Yolk Life agent to help you every step of the way.